The Ibadan Circular Road project has been mired in controversy, with allegations of irregularities in the procurement process and the contractors’ qualifications. This investigation reveals the hidden truths behind the project, including secret connections between the parties involved and intricate layers of deception masquerading as truth. Enoch Oyedibu of the International Centre for Investigative Reporting writes.

AS the sun dipped below the horizon, it cast a warm, golden glow across the sprawling expanse of the 32-kilometre East Wing of Ibadan Circular Road, nestled in the heart of Oyo State, Southwest Nigeria. The once bustling construction site, typically abuzz with activity, now lay enshrouded in an unsettling calmness as the hues of twilight enveloped it.

Renamed after former Governor Rashidi Adewolu Ladoja, who commenced the project, it is a key project that aims to not only ease traffic congestion but also boost urban development in the city of about 3.75 million people by 2022 estimates.

The actual construction took off during the tenure of late Governor Abiola Ajimobi with ENL Consortium Limited awarded a N67bn contract for the construction of a 32km section of the road, with high hopes for completion by 2019.

Since then, the trajectory of this crucial project has been fraught with controversies, delays, and conflicting contract pricing.

A road of dreams and challenges

Although the contract awarded to ENL Consortium Ltd was almost cancelled at first due to the slow pace of work, Governor Seyi Makinde, who came into office in 2019, later extended the deadline to 2020 under the condition that the 32km stretch of the road must be completed.

Meanwhile, ENL continued to face consistent criticisms from the state government due to slow progress and disagreements about contract pricing. Makinde claimed that the consortium had initially quoted N14bn for the contract, but Ajimobi’s government eventually approved it for N67bn. Makinde also said that sum of N11bn was earmarked for bush clearing.

In his response, ENL Consortium Chairperson and former Deputy Governor in Osun state, Adesuyi Haastrup, refuted the accusations, emphasizing that N11bn was meant to cover “a combination of 10 items for bush clearing and all earthworks of the entire 32km”.

On June 4, 2021, the Oyo State government revealed that ENL Consortium had only completed a mere 5.5 per cent of the entire project, a disappointing outcome given the extended timeframe. The consortium attributed this sluggish progress to the governor’s failure to fulfil his promise of providing a “Letter of Assurance of Continuity” to support their work.

“He promised he would write us a Letter of Assurance of Continuity for the work. He later did not honour his words,” Haastrup lamented, expressing his dismay at the broken commitment.

While ENL Consortium anxiously awaited the promised letter, the state government had already taken steps to consult with a new consortium, signalling the commencement of a new chapter in this evolving narrative.

The controversial journey of the briefcase consortium

In a whirlwind of events, on July 5, 2021, the newly formed Bureau of Investment Promotion and Public Private Partnership (now Oyo State Investment and Public Private Partnership Agency—OYSIPA) re-awarded the entire stretch of the 110km Ibadan Circular Road to another company, SEL-VYDRA consortium for a staggering N138.2bn.

This was about 14 months before the project was eventually flagged off in September 2022, with assurance from the state government that 75km of the road project would be completed before the end of his tenure (first term) in June 2023. The government asserted that it had saved the state approximately N77bn compared to the previous contract granted to ENL, factoring in inflationary trends. However, questions began to emerge about the consortium’s credentials and the transparency of the award process.

The road project was established as a Public Private Partnership (PPP) under a Build Operate and Transfer model, between the state government and contractor SEL-Vydra, contributing a ratio of 20 to 80 percent respectively.

The first 32km phase of the 110km road project embodies a four-lane, dual-carriage motorway that links the Lagos-Ibadan expressway to the Ibadan-Ife highway, incorporating diverse features such as bridges, interchanges, streetlights, security posts, and other essential road infrastructures.

Amidst these aspirations, concerns emerge surrounding the precise financial commitment of the state government. SEL-Vydra’s involvement is anticipated to contribute N110.5bn, establishing an 80 percent ownership stake in the venture. Counterpart funding from the state government, however, is met with a degree of discrepancy.

Twenty per cent of the contract amount, N138.2 billion, logically equates to N27.64 billion, yet budgetary details and statements from Oyo’s commissioner for Works, Dahud Sangodoyin, reveal varying figures. The approved 2021 supplementary budget earmarks N25bn for counterpart funding. However, Prof. Sangodoyin later cited N35.97bn for the same item.

Sangodoyin, said while addressing pressmen on March 4, 2023, that the counterpart funding the state is contributing is N35.97bn, and is channelled towards the execution of interchanges and bridges construction on the 32km Southeast segment of the 110km road.

However, this was a separate contract awarded to Craneburg Construction Company on March 17, 2022, according to the Oyo State Procurement portal. The commissioner added that the bridges and interchanges would be finalised by June 2023.

A search shows that Craneburg was officially registered with the Corporate Affairs Commission, CAC, on April 15, 2013. Online business registry, NG-Check.com showed Gilbert Sassine and Larissa Okpala as directors.

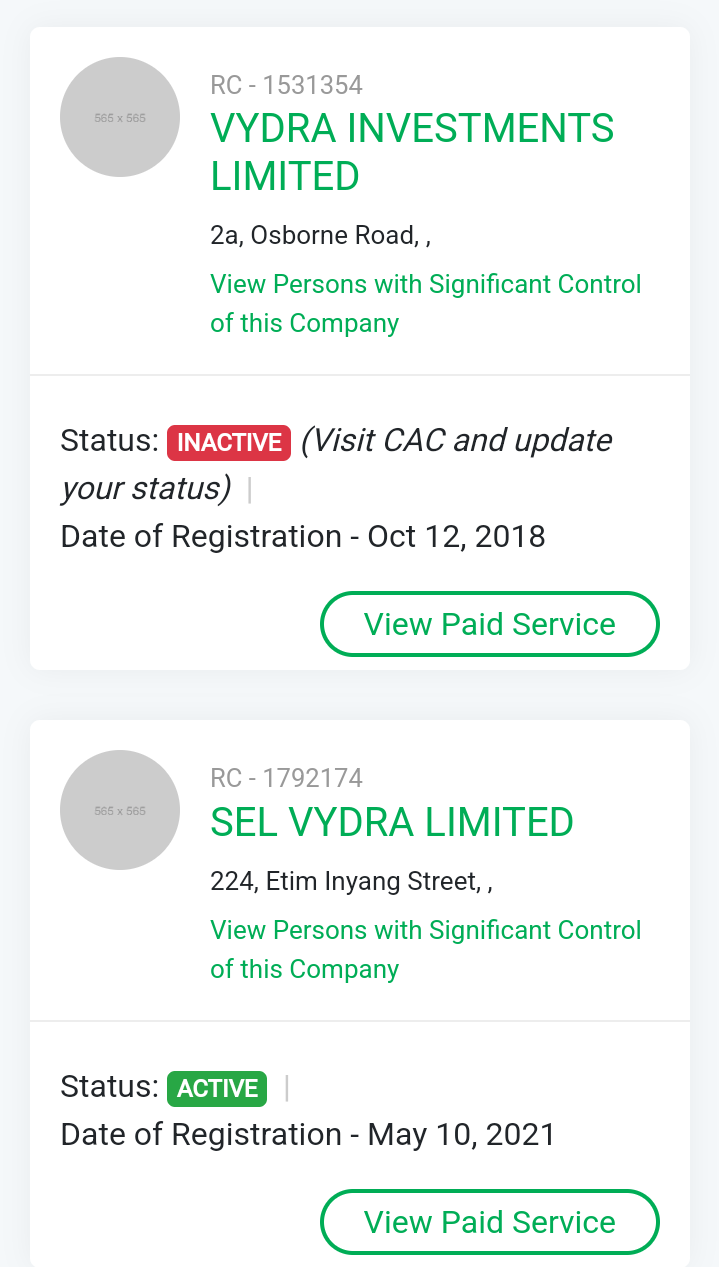

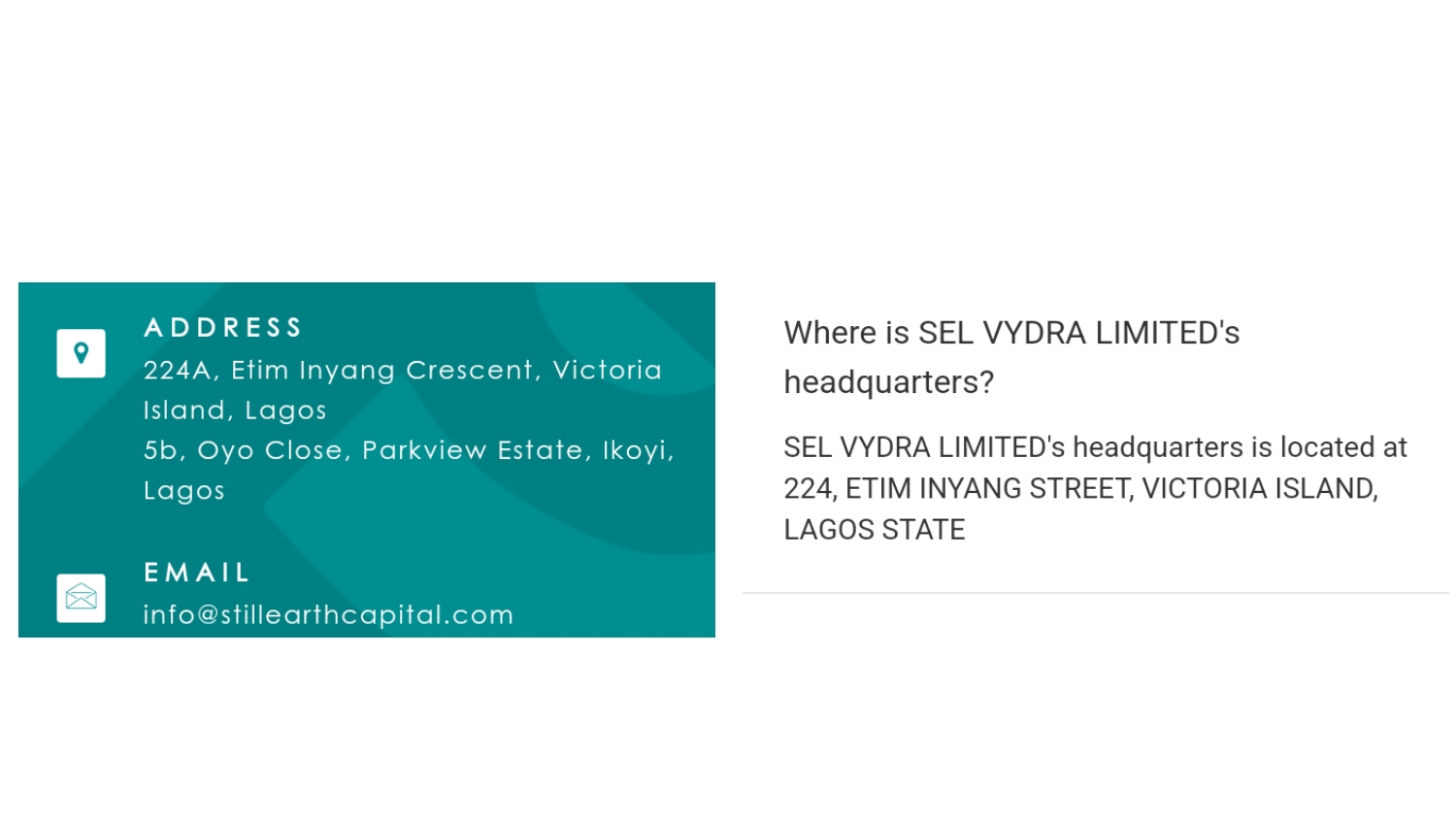

In the same fashion, investigations reveal that SEL-VYDRA was registered merely two months before it was granted the contract—specifically on May 10, 2021.

Alarmingly, neither of the two constituent companies within the consortium, namely Still Earth Capital Finance Limited and Vydra, possessed any prior road construction experience in managing a project of this magnitude and complexity.

This contravenes Part IV, Section 8 of the Oyo State Procurement Law (2010), which outlines several grounds for disqualifying a contractor’s bid or tender from a procurement process. Notably, subsection (b) of the aforementioned section stipulates that “a supplier, contractor, or consultant who, in the three years preceding the initiation of the relevant procurement proceedings, demonstrated inadequate performance or lack of due diligence in fulfilling any previous public procurement obligation” shall be ineligible to participate in the said procurement proceedings.

These rules were established as clear guidelines to dismiss any bids that did not comply. Despite the infractions, SEL-VYDRA was awarded a substantial N138bn project under the Build Operate and Transfer (BOT) model.

In the face of public scrutiny and questioning, the Oyo State government attempted to address concerns by providing explanations, asserting that it had not committed any wrongdoing. The government claimed that the usage of a Special Purpose Vehicle (SPV) to execute such projects was permitted under relevant laws of the state.

The applicability of two key laws is evident in this context: the Oyo State Investment, Public-Private Partnership (OYSIPA) Law (2019), which governs the operations of the procuring entity, and the Oyo State Public-Private Partnership (2013) Law. Both of these laws incorporate the Oyo State Procurement Law in their provisions.

Notably, the Oyo State Public-Private Partnership (2013) Law serves as a practical guide for public-private partnership projects, within which a clause outlining the utilization of SPVs is included. Similarly, the Oyo State Investment, Public-Private Partnership (OYISPA) Law includes a provision concerning SPVs, which were later designated as private sector partners or concessionaires.

However, it is important to emphasize that no segment of the Oyo State Procurement Law (2010) contains explicit provision regarding the use of SPVs. While it is comprehensible that the Oyo State Public-Private Partnership Law (2013) permits the use of Special Purpose Vehicles (SPVs) for project execution, it is worth noting that the OYSIPA Law (2019), does not compromise on the principles of competence and transparency in the composition of these SPVs.

Section 30, subsection 9 of the law stipulates that “the agency (OYSIPA) shall ensure that the concessionaires or private sector partners for public private partnership projects shall be selected through a transparent, efficient and competitive procedure, adapted to the peculiarities of the different projects selected for the public private partnership arrangement.”

The Oyo State Procurement Law (2010) outlines a comprehensive set of prerequisites for contractors vying for bids or contract awards. These encompass a range of documents such as CAC Registration, Payment Receipts, Company’s Income Tax Clearance, Personal Income Tax Clearance, VAT Registration Certificate, Company Profile with Resumes, Government-issued IDs of Key Personnel, Memorandum & Articles of Association, Evidence of Past Projects, Bank Reference Letters, and a Company’s 3-Year Financial Summary.

These prerequisites are fundamental for contractors participating in the bidding process and being eligible for contract awards. However, in the case of SEL-Vydra, their registration occurred just two months before the contract was awarded in 2021, leaving insufficient time to amass the required documents, particularly the 3-year financial summary.

In contrast to well-established construction firms with substantial experience, SEL-Vydra’s limitations become evident, prompting significant questions about the decision to award the contract to a relatively new player in the construction sector.

WHAT IS SEL?

Still Earth Capital Finance Limited, also known as SEL Capital is a “financial services” rendering company, with Mr. Olusegun Opaleye as its director. However, a representative from the company said that Opaleye left the company in 2022.

Findings showed that SEL is chaired by Mutiu Sunmonu CON, while the director is Oyindamola Samira Adeyemi. Both individuals seem to have ‘political’ connections to the current governor of the state, Seyi Makinde.

Sunmonu and Seyi Makinde are both former employees of Shell Petroleum Development Company of Nigeria (SPDC) while Adeyemi has affiliations with the People’s Democratic Party (PDP), the ruling party in the State. Segun Odegbami, a footballer turned politician and former captain of the national soccer team, Super Eagles, is also one of the shareholders of the company.

A few more eyebrow-raising revelations come to light. Sunmonu, who holds a significant role in the SEL-VYDRA consortium is also the chairman of Julius Berger. This raises questions, as Julius Berger, being a renowned construction company, has the capability to bid for the contract independently, without the need for the establishment of a new consortium. This suggests the possibility of personal interests at play.

A lady named Esther, who declined to provide her last name but identified herself as the legal advisor of the company, SEL Capital, stated that the company is a subsidiary of Still Earth Holdings.

Among the array of companies associated with Still Earth, Still Earth Construction and Realty stands as the solitary subsidiary exclusively focused on construction.

The rationale behind the decision to bid for the contract using SEL Capital instead of Still Earth Construction and Realty remains unclear.

WHAT IS VYDRA?

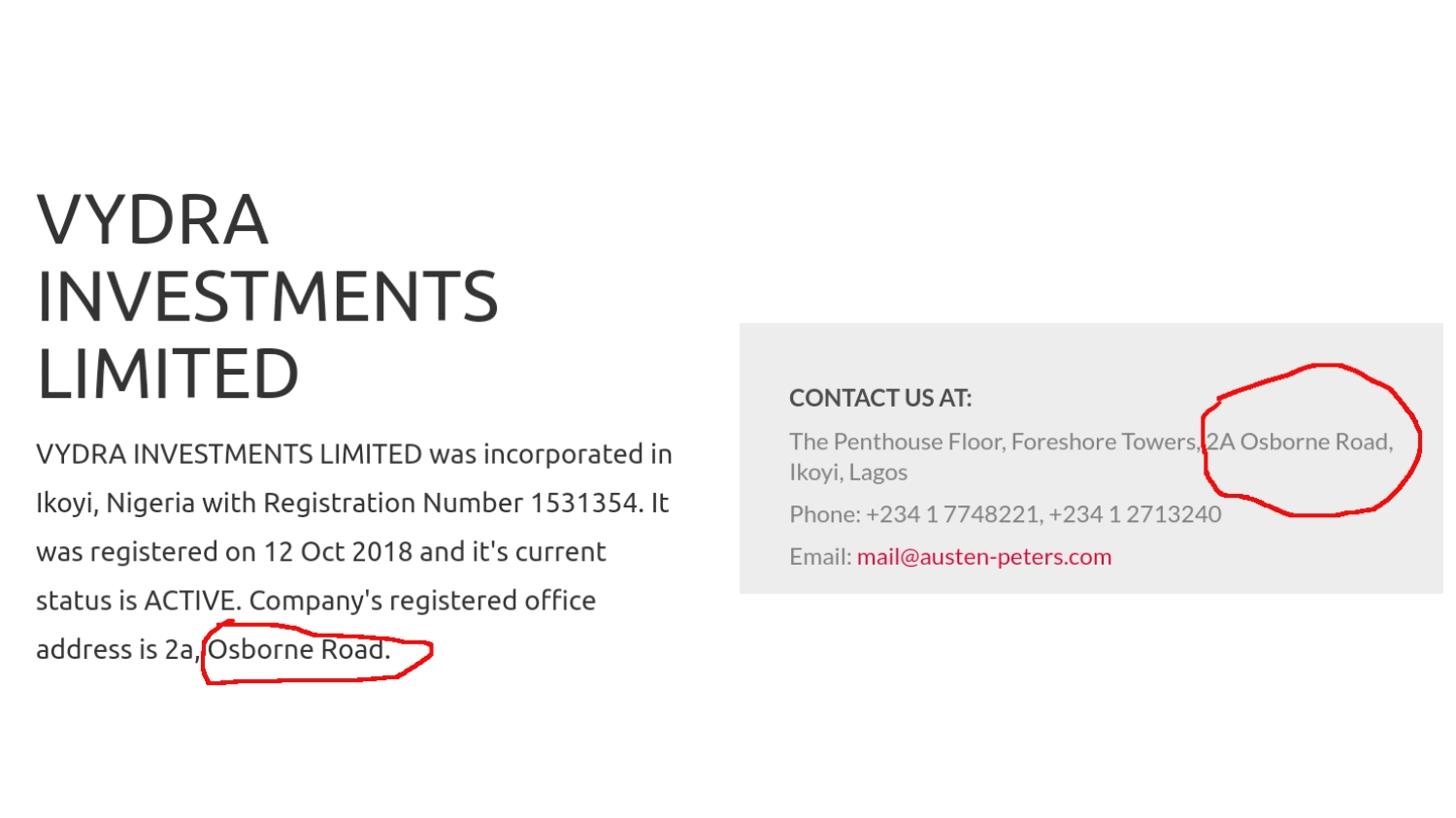

“They don’t exist,” said Jerome Kalu, a Lagos-based fixer who paid a visit to Vydra’s address at the 2A, Osborne, Ikoyi Lagos. “At Foreshore Towers, 2A Osborne Road, Ikoyi, Lagos, there’s nowhere or nothing like Vydra Investment, but just Austen-Peters and other…”

According to the online corporate registry ng-check.ng, VYDRA Investment was registered on October 12, 2018, with Michael Msughter Dugeri and Anthony Adedapo Makinde as its directors. Intriguingly, both individuals hold positions as Senior Associates at Austen-Peters & Co law firm, sharing the same address as Vydra.

The connections surrounding Vydra, and its related entities raise concerns about potential beneficial ownership and the intricacies of their relationships.

One notable link is Anthony Adedapo MAKINDE, a director associated with the company. What draws attention is that the company (VYDRA) shares the same address as Austen-Peters & Co, whose principal partner is Timi Austen-Peters, a lawyer and chairman of Dorman Long Engineering Limited.

Adding a riveting twist, Dorman Long Engineering Limited boasts an extensive roster of 29 directors and shareholders, among whom is Mr. Godwin Obaseki, the Governor of Edo State and a prominent member of the People’s Democratic Party, the same political party as Governor Seyi Makinde.

Furthermore, Governor Makinde, an alumnus of UNILAG, graduated in 1991 alongside a fellow student bearing the name MAKINDE A. A. While confirmation of whether the “A. A.” signifies “Anthony Adedapo” remains elusive, it does raise the suspicion that one of the directors of Vydra may have a direct or indirect connection to the governor.

However, the Oyo State Procurement Law (2010) explicitly frowns upon any form of direct or indirect government personnel involvement in the procurement process.

Section 24 of the law states that, “Persons who have been engaged in preparing for a procurement or part of the proceedings thereof may neither bid for the procurement in question or any part thereof either as main contractor or sub-contractor nor may they cooperate in any manner with bidders in the course of preparing their tenders.”

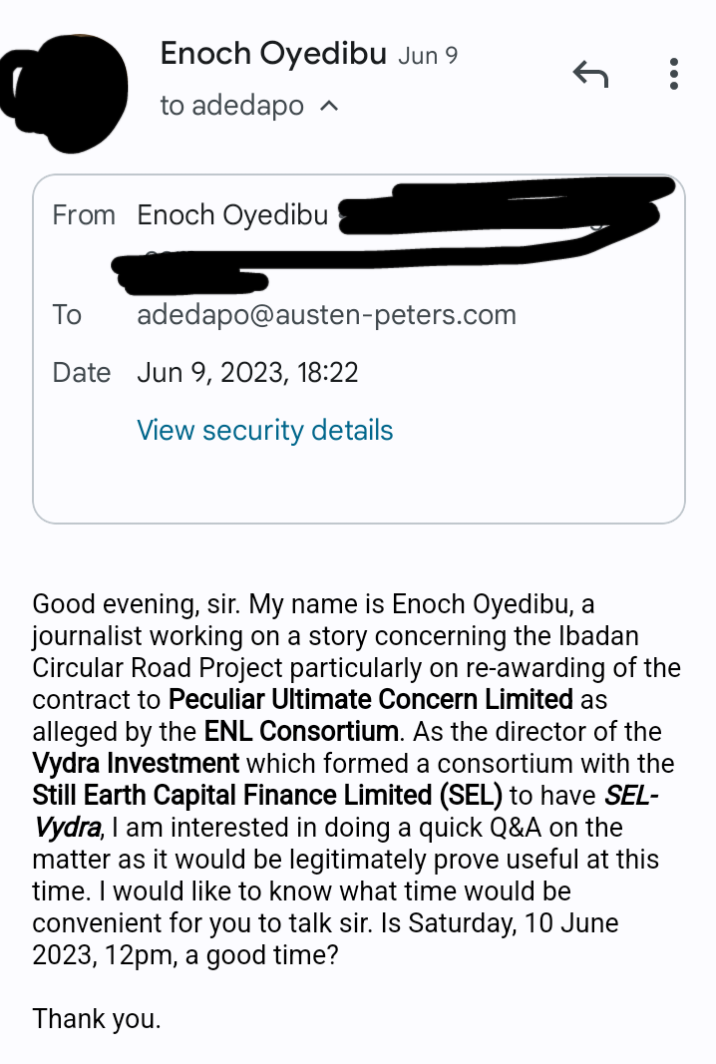

Attempts to schedule an in-person meeting with Anthony Adedapo Makinde at Austen-Peters’ office were unsuccessful. An email sent to Adedapo Makinde via Adedapo@austen-peters.com got no response leaving a trove of unanswered questions about the connections and vested interested surrounding SEL-Vydra. We might have to send someone from our Lagos office to speak with him.

A Tale of confusion and intrigues

In response to the contract cancellation, the ENL Consortium filed a lawsuit against the state government and other contractors involved in the project. Their claim is straightforward: that the contract was re-awarded to SEL-Vydra in bad faith.

ENL Consortium further contends that the state government subsequently reassigned a segment of the contract – originally designated for SEL-Vydra – to other entities. Notable among these recipients are Craneburg Construction Company and Peculiar Ultimate Concern Limited.

Efforts to get comments from ENL Consortium through its lead counsel, Olaniwun Ajayi, LP, regarding the Ibadan Circular Road case proved abortive. Speaking with Mr. Joshua Ayanda, a lawyer at the firm also proved challenging, as he was uncooperative and evasive about his involvement in the case.

Contradicting the information provided by the client care agent of the law firm who initially facilitated the phone call to Ayanda, he denied any connection to the case, stating, “I cannot speak on the case. I am not the counsel on the case.”

When repeated calls were made by this reporter, his line was blocked. Subsequently, another client care agent, speaking over the phone, assured the reporter of facilitating a conversation with Opasanya Oluseye, SAN, the main counsel, but failed to do so as of the time of filing this report.

Amongst other issues, ENL Consortium accused SEL-Vydra Consortium of improperly re-awarding the Ibadan Circular Road contract to Peculiar Ultimate Concern Limited, a company headed by Mr. Abel Olanrewaju Adeleke.

Efforts to contact Peculiar Ultimate Concern Limited on three occasions yielded no success. Calls directed to the established company contact were abruptly terminated as soon as Mr. Michael, the individual who answered the call, knew who was on the line.

As of the time of visit to the project site, on May 28 and 29 of this year, 2023, construction on the road has not reached the promised 75km target set for June 2023. Notably, on-site observations indicated a conspicuous absence of SEL-Vydra, while the active involvement of Craneburg Construction Company in the project was evident.

Efforts to obtain information from the Oyo State Ministry of Works and OYSIPA regarding bid details, approved contract sums, durations, completion dates for contracts awarded to SEL-Vydra and Craneburg Construction Company, as well as releases made to contractors, proved abortive. Despite submitting Freedom of Information Act (FOIA) applications, both initial and reminder letters, on June 27 and July 12 respectively, got no response or acknowledgment.

Questionable motives behind awarding Ibadan circular road project to SEL-Vydra Consortium

Ilevbaoje Uadamen is a procurement fraud expert, and founder of Monitng, a civic technology platform that provides citizens with information to track the progress of public projects, access public data, and engage in civic advocacy. He said the idea behind awarding Ibadan Circular Road project to SEL-Vydra is questionable and a replica of what was done on the Lekki Toll Gate in Lagos.

“The way this thing works is that some governors want to remain financially relevant even after leaving office so they come up with these Public Private Partnership projects, forming consortium to build roads on Build, Operate and Transfer (BOT) model that will be tolled.”

A BOT contract model finances significant projects, especially infrastructure, in public-private partnerships. It involves a concession from a public entity to a private firm to construct and manage the project. After a fixed period, control returns to the public entity.

“The private entity will build the project by itself, own it for a period of 30 to 35 years, then transfer it to the public entity, which is the government. But most of these construction companies involved as consortium or private entities are directly or indirectly related to the government officials.

“So, at the end you’ll find out that a road built with public funds is used to enrich some private bodies. They want to leave the government and remain relevant. In the next 30 years when the road is tolled, they will be in their comfort zone and be cashing out. If such roads are being awarded to Julius Berger and the likes, do you think something like this will occur?” he said.

“The counterpart funding is just a way to launder the public funds. They make use of funds suitable enough to build the road as counterpart funding and lie that other entities own the biggest shares.”

This investigation is supported by the John D. and Catherine T. MacArthur Foundation and the International Centre for Investigative Reporting.